|

Someone I had worked with a few years ago contacted me out of the blue last week, espousing their disappointment over the flat sales for their new eCommerce business. They had a great idea, but their momentum fell flat one week after their official launch. I spent the better half of an hour digging for more details in a quest to help get their newest endeavor back on track. Truth be told, this client was not experiencing an unusual struggle. Achieving sustainable growth with an online business is hard work. In fact, 22 percent of eCommerce businesses fail within their first year. eCommerce is not as easy as it looks. You can have the most innovative products on the market and still not attract customers.businesssearch.org/faq-small-business/ There are several reasons why eCommerce websites fail. Here are just a few:

Ditch the poor design A poorly designed eCommerce site can cause potential shoppers to flee in a hurry. Information overload is one of the biggest faux-pas online business owners commit. Trust me when I say more is not necessarily better. Cramming too much information onto a single page will cause visitors to bounce faster than Tigger on his way to a picnic with Pooh. The only thing worse than too much information on a page is low-quality graphics or an over-abundance of them. Flashing gifs, colored backgrounds on top of other colored backgrounds, and low-resolution photos enlarged until they are super fuzzy do not make a great first impression. Not everyone is an artist or a graphic designer. Consulting with a person well-versed in graphics can help with avoiding this pitfall and is worth the investment. Pop-ups also annoy visitors to your site and make it difficult to navigate to pertinent information. I’m not saying you should never use pop-ups on your site. Use them sparingly and do not program them to continue to emerge until visitors take you up on whatever you are offering. If they must keep closing a pop-up box every time they navigate to a new page on your site, they will abandon your page. These are just a few tips for designing a more user-friendly eCommerce site. I can get into more detail with online retailers interested in improving their sites. Streamline the checkout process To say consumers have become spoiled with free shipping over the years is an understatement. They don’t just expect it, they demand it. Online businesses that fail to offer this perk will find online shoppers committing cart abandonment and taking their dollars elsewhere. There are ways to incorporate the cost of shipping into product pricing so that you aren’t losing money on free shipping. Somewhere in the back of their minds, most customers know this happens. Still, there is something about seeing a $0 next to the estimated shipping costs line during checkout that makes them giddy. Other ways to streamline your checkout process:

As of the writing of this blog, 1.8 million online retailers were operating in the U.S. alone. If you add in global eCommerce, the figure jumps to 7.1 million. That is a lot of competition, which is why online business owners must go the extra mile to help themselves stand out from the crowd. One of the most trusted and relevant ways to build brand authority is with quality content. Whether it is a blog offering tips about how to use your products, or a weekly podcast to discuss the state of the industry, providing value-added tools for your customers boosts engagement and encourages brand loyalty. eCommerce SEO tactics also draw eyeballs to your site. Take the time to use relevant (and unique) keywords for every page and every product on your site. Yes, it is a lot of work to do this, but the effort is well worth the reward. Create a top-notch marketing strategy There is more to marketing your online business than taking out a few paid ads on Facebook or other social media platforms. Investing randomly in advertising does not produce fruitful results. Sometimes it propels your eCommerce site into a death spiral from which it cannot recover. Claiming your Google My Business account and tapping into influencer marketing are just a few of the marketing strategies that convert leads into loyal customers. Working with a marketing professional is the best way to craft a plan that takes your unique selling proposition and goals for growth into account. Crushing your eCommerce goals Ready to crush it online? Do you dare to think big and ditch those limiting beliefs that stand between success and failure? Reach out to The Write Reflection™ today for more tips on how to go from eCommerce newbie to online sales sensation.

0 Comments

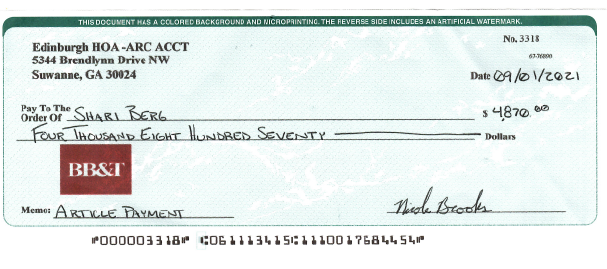

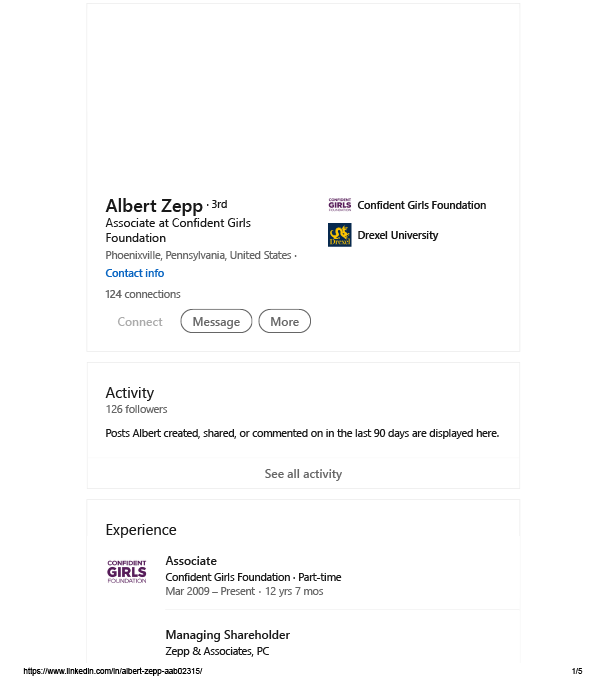

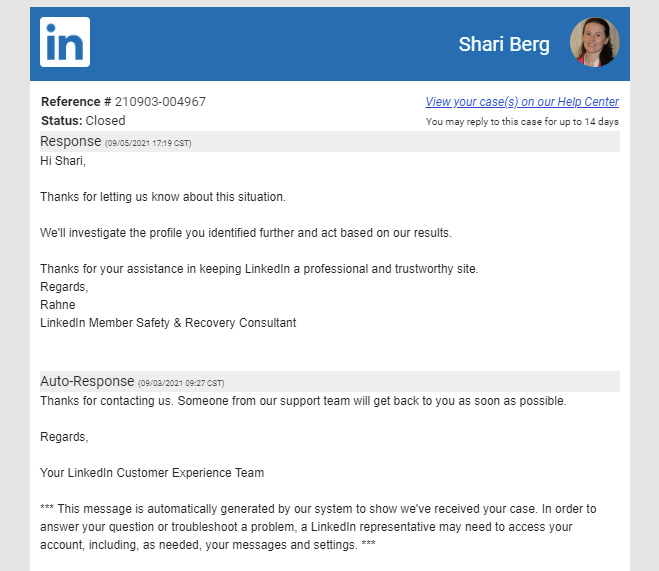

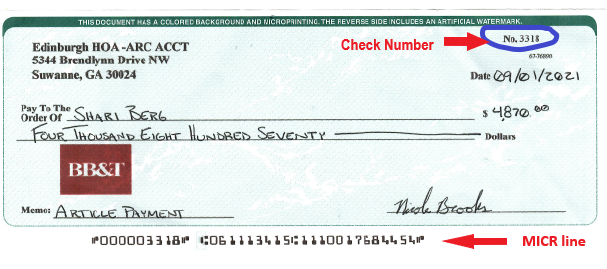

Write Reflection brand enthusiasts who have followed my blog for a while know that I normally write about helpful copywriting tips. Other times, I feature fellow creative people doing awesome things in this space. Today, I want to use my platform to warn my fellow copywriters and other professional services providers about a sneaky swindle making the rounds. Scammers have put a twist on the age-old check-cashing scheme trying to trick service providers out of their hard-earned cash. The perpetrators tried to pull their ruse on me last week. They picked the wrong person to try to cheat. Thankfully, I caught on rather quickly to their con. During my investigation into the matter, I discovered that other hard-working copywriters and service professionals like myself were not so lucky. Some of them lost thousands to these dastardly crooks. I want to make sure it does not happen to anyone else, so I am putting those con artists on blast. Right here. Right now. The con: overpayment for services Their approach started out like any other prospective client reaching out to discuss my services. A gentleman calling himself Albert Zepp sent me an InMail request on LinkedIn, asking if I was available to handle a research article for his company. I thought nothing of it because many of my current clients have contacted me through LinkedIn. It is, after all, a professional networking site. After exchanging a few messages about the job requirements, I forwarded my standard contract. Like all service professionals, I require an upfront deposit before I get started. I discussed my fee with Mr. Zepp and he agreed to overnight it to me since he needed me to get started ASAP to meet his tight deadline. The next day, a UPS delivery driver stopped by with my advance deposit from the client. When I opened the envelope, I discovered the check was for nearly three times the amount I required from the client. That was my first red flag. The second thing I noticed was the check was issued by an HOA in Georgia that had nothing to do with the client who was ordering the work. That was my second red flag. One red flag I could have brushed off, but two? My reporter’s instincts kicked in. I spent the next several hours investigating everything I could about this supposed Mr. Zepp and the organization that allegedly had issued the check. I discovered two things: Mr. Zepp was a real person (at least on paper), and the HOA was legitimate. Still, I had a nagging feeling. So, I tracked down a number for the HOA and called them. The person who answered the phone was exasperated the minute I explained why I was calling. No, she did not know this person who contacted me, and yes, this was some elaborate check fraud scheme in which her organization also was a victim. There is a saying that the worst thing you can do is try to con a con. Here is a new warning for scammers out there. The second worst thing you can try to do is con a former reporter. The investigation: a reporter follows her gut Once I knew I was dealing with an elaborate ruse to steal from me, I got a teensy bit angry. I work hard, as do most small business owners. I do not work this hard so that some schmuck can steal from me and my family. According to the person from the HOA, more than a dozen other service professionals had called her with similar stories in the last month. Some of them cashed the check and found out the hard way they had been swindled. What if like them, I had cashed this check and started to work, only to find out later the check was fake when it bounced? Once I knew what I was dealing with, I started to dig a little deeper. The first thing I did was call the local police to report the attempted fraud. Although they really cannot do anything about it, I wanted it on record in case I need the police report later. I also reported it to the Federal Trade Commission and the FBI’s Internet Crime Complaint Center. All these things combined help get the word out to law enforcement across the country about this scam. I also reported it to LinkedIn’s Help Center. A LinkedIn representative acknowledge my report was received and sent this response: After reporting the incident to all the proper authorities, I tried to catch the fake Mr. Zepp up in a few more lies so I could provide the HOA with some ammunition for their police investigation in Georgia. I sent a new message to him, letting him know he had sent me too much money. I was expecting him to tell me that I could cash the check and then write him a return check for the difference. That is a common check fraud scheme known as an overpayment. The fraudster sends you too much money (on a fake check) and dupes you into sending them a legitimate check back to refund them for the overpayment. When he replied, he instead said his partners wanted me to work on two stories, so they were sending advance payment for both. He urged me to cash the check so we could get started. I suspect at some point he would have eventually canceled the project and asked for his money back, trying to fool me into sending him nearly $5,000 in legitimate funds. I will never know for sure because I have blocked the fake Mr. Z from communicating with me further. As of the writing of this post, I still am trying to track down the real Mr. Zepp. According to what I have found online, he appears to be a certified public accountant in the Philadelphia area. Let me be clear: I do not believe for one minute I was interacting with the real Mr. Zepp on LinkedIn or via email. I have a hunch someone has hijacked his persona. If it were me, I would want to know someone was using my name in the commission of a crime, so I will continue to do my best to locate the real Mr. Z and let him know what has happened. How to spot a fake check If you are wondering how I knew it was a fake check, I am going to let you in on some secrets about how you can tell so this never happens to any of you. Fake checks can be difficult – but not impossible – to spot. Scammers go to great lengths to pull off their heists. Banks and other financial institutions process them all the time without noticing the signs. They use the names of real people, organizations, and even financial institutions on their fake checks. Sometimes, they use real checks that belong to real people who were victims of identity fraud. Those kinds of losers are even worse than the ones who print fake checks on their home printers. It often takes banks weeks to figure out a check is not legit. In the case of the check I received, it was made out for $4,870 even. Why? Well, here is another secret I will let you in on: scammers know that banks process checks under $5,000 and make them available in the depositor’s account within five days. Federal regulations require it. A person is more likely to fall for the ruse if they can see the check “cleared” and is posted in their available balance. By the time you and the financial institutions realize that hefty check was not real, you are on the hook for the total amount. Here are some other tell-tale signs that check you are holding is not the real thing:

It is not hard to understand why businesses fall for check fraud scams. They are eager to attract new customers. Small businesses are especially vulnerable to these cons because they are looking to grow their brands. Waving large checks in the faces of business owners who may be struggling to survive post-pandemic makes it even more tempting. When the fake Mr. Zepp tried to scam me, I could have simply moved on from the experience and considered myself lucky. After a few days mulling it over, I decided to shine a light on what this unscrupulous fraudster tried to pull on me in the hopes of sparing others the kind of financial ruin falling for these kinds of schemes can cause. I also am cooperating with the HOA in Georgia to supply them with any information or resources that may prove beneficial in tracking down this loser so he cannot do this to anyone else. Be careful out there, friends and followers. Not everyone wishes you well and there are plenty of con artists looking to make a quick buck. Do not let the money that lines their pockets be yours. |

Categories

All

Archives

April 2024

|